We are acutely aware of what is needed to achieve physical health and fitness and our mental wellbeing is more and more at the forefront of our minds, but what is often forgotten is our ‘Money fitness’, which has a direct effect on both our physical and mental wellbeing!

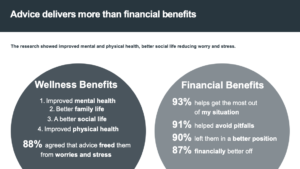

In a study conducted across 12,643 Australians, IOOF in partnership with CoreData conducted research into the value of individuals receiving financial advice versus those who have not received any form of financial advice, with some astounding results.

Of those surveyed, 88% of those clients who are actively sought to improve their ‘Money’ fitness through financial advice stated that they felt improved mental health, enjoy a better family life, a better social life and improve physical health. That in itself is a fair enough incentive to want to get affairs in order when it comes to your ‘Money’ fitness!

Of those surveyed, 88% of those clients who are actively sought to improve their ‘Money’ fitness through financial advice stated that they felt improved mental health, enjoy a better family life, a better social life and improve physical health. That in itself is a fair enough incentive to want to get affairs in order when it comes to your ‘Money’ fitness!

So what does it mean to be Money fit? You don’t need to have a bank balance like Rockefeller to be financially fit! There are some key areas that you will need to consider to ensure you are in the best position possible financially to enjoy life now and in the future. These include:

- Understanding your cash flow and, dare I say it, a budget! This is first and foremost the most important ingredient in any successful financial plan

- Having realistic short, medium and long-term objectives that are focused on the lifestyle that you would like to lead. Having realistic lifestyle goals and objectives, that are attainable will give you peace of mind

- A personal protection plan. This is your Plan B and is important to make sure that you and your family are going to be financially okay in the event of the unforeseen

- A wealth creation strategy. This does not need to be war and peace, but can be a simple plan that focuses on creating enough wealth over time to make sure that you enjoy a fruitful retirement and desired lifestyle

- Get Advice! Getting the right advice is absolutely critical to achieving the best outcome for you

To maintain optimal physical fitness, you need to continue to work on it. It is no different for your money health. Regular reviews and updates should be undertaken to ensure that your optimal financial health is maintained.

For assistance in improving your very own financial fitness, please reach out to arrange a free consultation today by clicking here.

Alternatively, you can create your very own wealth report and in just 10 minutes you’ll have a personal life snapshot of your financial fitness by clicking here.